If you’re conducting sales transactions in the province of Indiana, you’ll require the Indiana Bill of Sale form. To assist you, we are providing a printable template for the Indiana bill of sale in the following article. This template will enable you to create a formal bill of sale, ensuring the legality and validity of your sales in Indiana. The bill of sale serves the purpose of documenting and recording the sales transactions between the buyer and seller.

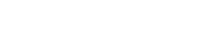

Printable Indiana Bill of Sale Form

Both sellers and buyers share the responsibility of engaging in sales transactions with a valid bill of sale. The bill of sale is essential for the seller to transfer the legal ownership or title of the item to the buyer. Without a proper bill of sale, the sale transaction lacks legal recognition and validity according to the law of sale. It is crucial to ensure the presence of a bill of sale to establish the legal framework for the transaction.

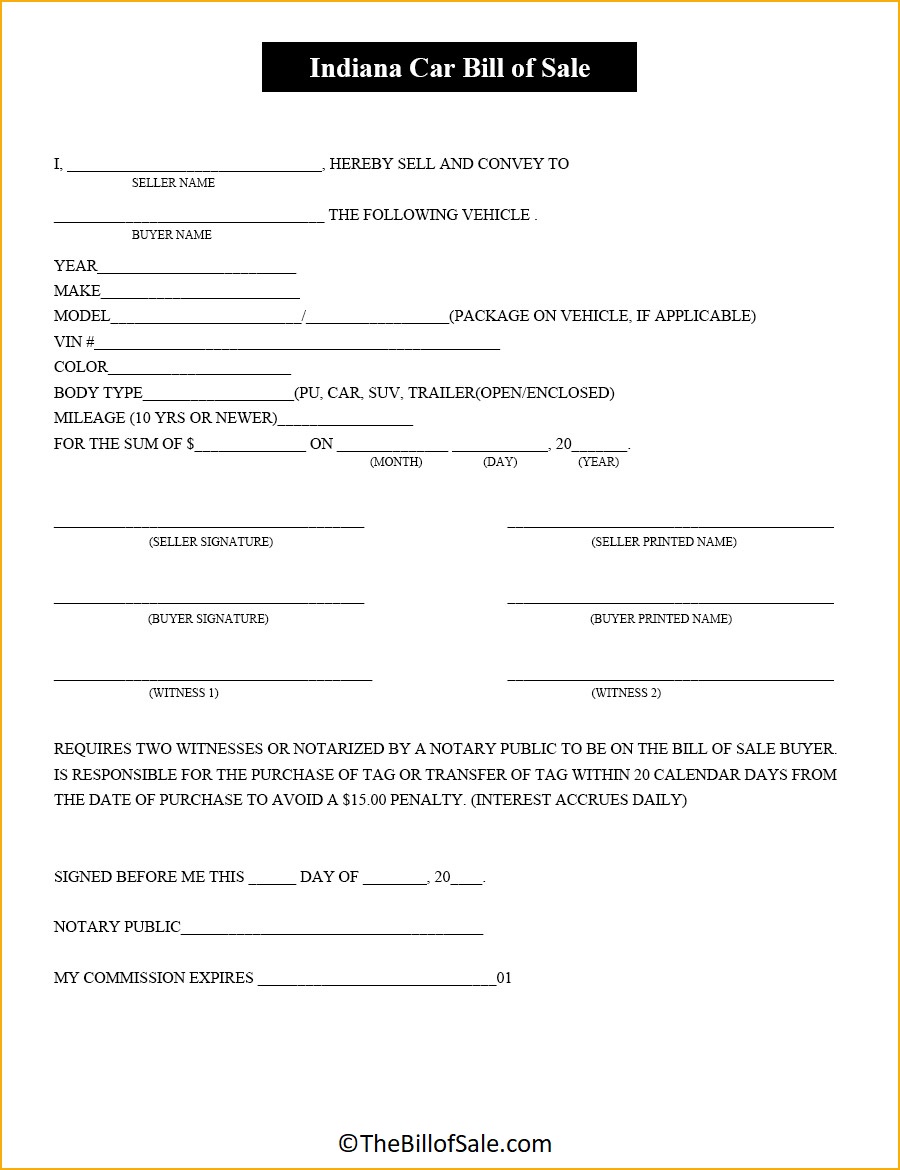

Indiana General Bill of Sale Form

Indiana is a state located in the Midwestern region of the United States. We are pleased to provide you with the Indiana Bill of Sale Form Template, which will be useful when buying or selling any item. A bill of sale enables you to transfer ownership to another individual, with the original document typically retained by the buyer and provided by the seller. These templates are printable, allowing you to download them and obtain a physical copy of the bill.

To access these printable templates, simply visit our website and download the template of your choice. They are available in two formats: image and PDF. If you opt for the PDF format, you can edit the template to add or remove information, which is necessary if you intend to use it for business purposes. Personal information, such as names, addresses, and signatures, must be provided by the seller or buyer for the document to serve its purpose.

However, if you plan to use the templates for educational purposes, editing is not required. You can simply download them and study their contents. In Indiana, a bill of sale does not need to be notarized unless ownership transfer is involved. Nonetheless, notarization is recommended as it can prove beneficial in the future, helping you keep track of your assets and facilitating taxation.

Indiana shares its borders with Michigan and Lake Michigan to the north, Ohio to the east, Kentucky to the south, and Illinois to the west. The state’s topography encompasses a blend of farmland, rivers, forests, plains, and lakes. While a handwritten bill of sale is acceptable in Indiana, it should include all the essential information that identifies both parties, including their names and signatures.

In this era of laptops and smartphones, obtaining information with a simple touch has become the norm. Our printable templates contribute to this convenience. Handwriting a bill of sale increases the risk of errors and mistakes, which is undesirable when engaging in business or buying/selling items. By using our templates, you can minimize the possibility of errors and ensure that the information provided is accurate and error-free. In addition to accuracy, presentation is also crucial.

Utilizing our printable templates demonstrates your professionalism and commitment to the transaction. With just a few clicks, you can access these templates, and the best part is that they are completely free of charge. We do not require any payment for accessing the forms. Therefore, you can obtain as many templates as you need or desire. These templates can be printed using any type of printer. Since the state of Indiana does not provide such forms, our templates make the process easier and more efficient for you.

A bill of sale is an essential requirement in any sale transaction as it serves as the valid proof of sale, not only for the buyers and sellers but also in the eyes of the law. Once the sale’s completed, it is necessary to fill out the bill of sale and submit it to the relevant authorities to ensure the transaction is officially recognized.

To safeguard against future complications, it is advisable to have your bill of sale notarized and properly documented. The form provides empty fields that need to completed by the parties involved in the transaction. These include the names of the buyer and seller, the date of the transaction. Their respective addresses, signatures, and any conditions of the sale. Additionally, it important to include the name and value of the item sale in the form. The user-friendly design of these forms ensures ease of understanding and enables you to finalize the transaction correctly.

As mentioned earlier, while notarization is not obligatory. It can be a prudent step to ensure that neither the buyer nor the seller can later renounce the agreement. The conditions stated in the bill. Which taken into account during the transaction, can serve as grounds for cancelling the deal if they not fulfilled. This can apply both before and after the completion of the transaction.

Moreover, the bill of sale holds significance in resolving tax-related matters associated with the specific sale. Therefore, considering these various aspects, the bill of sale emerges as an essential document in all sales-related transactions.

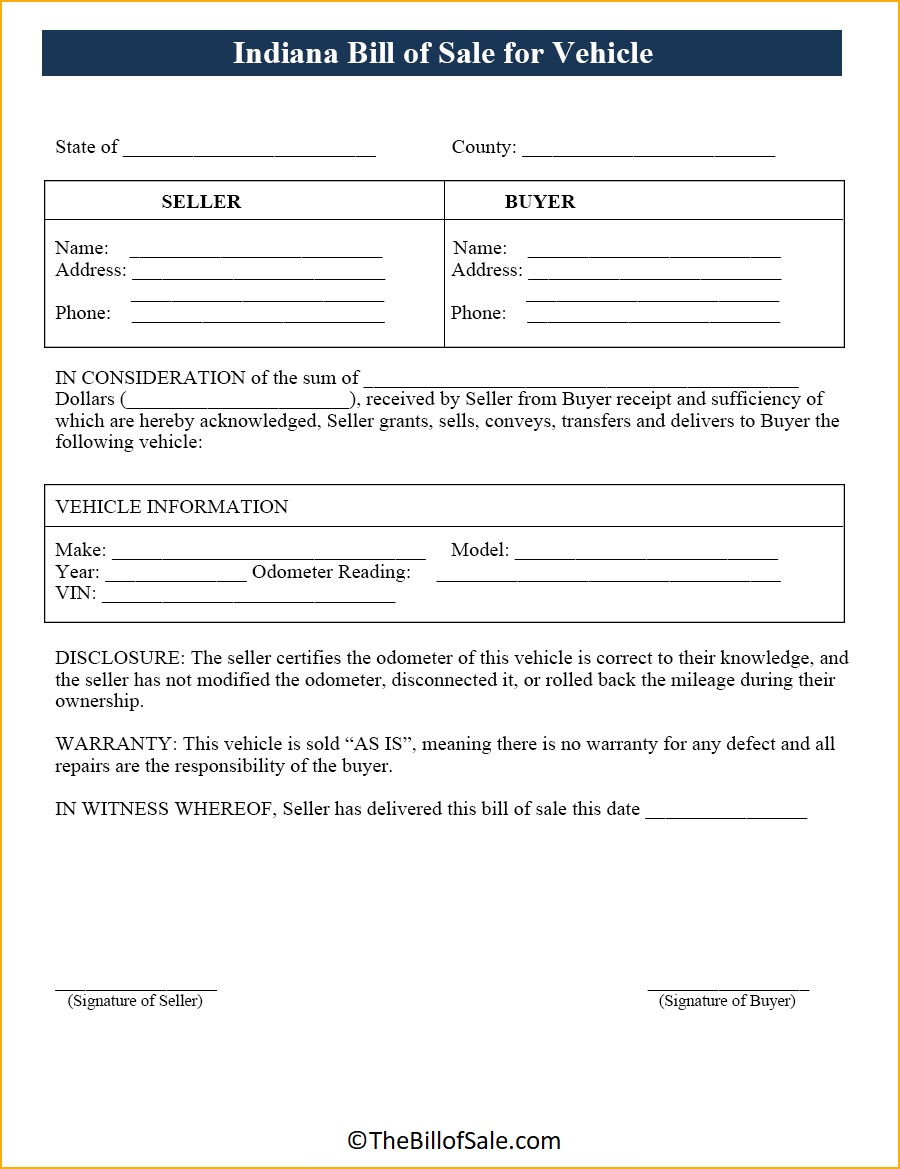

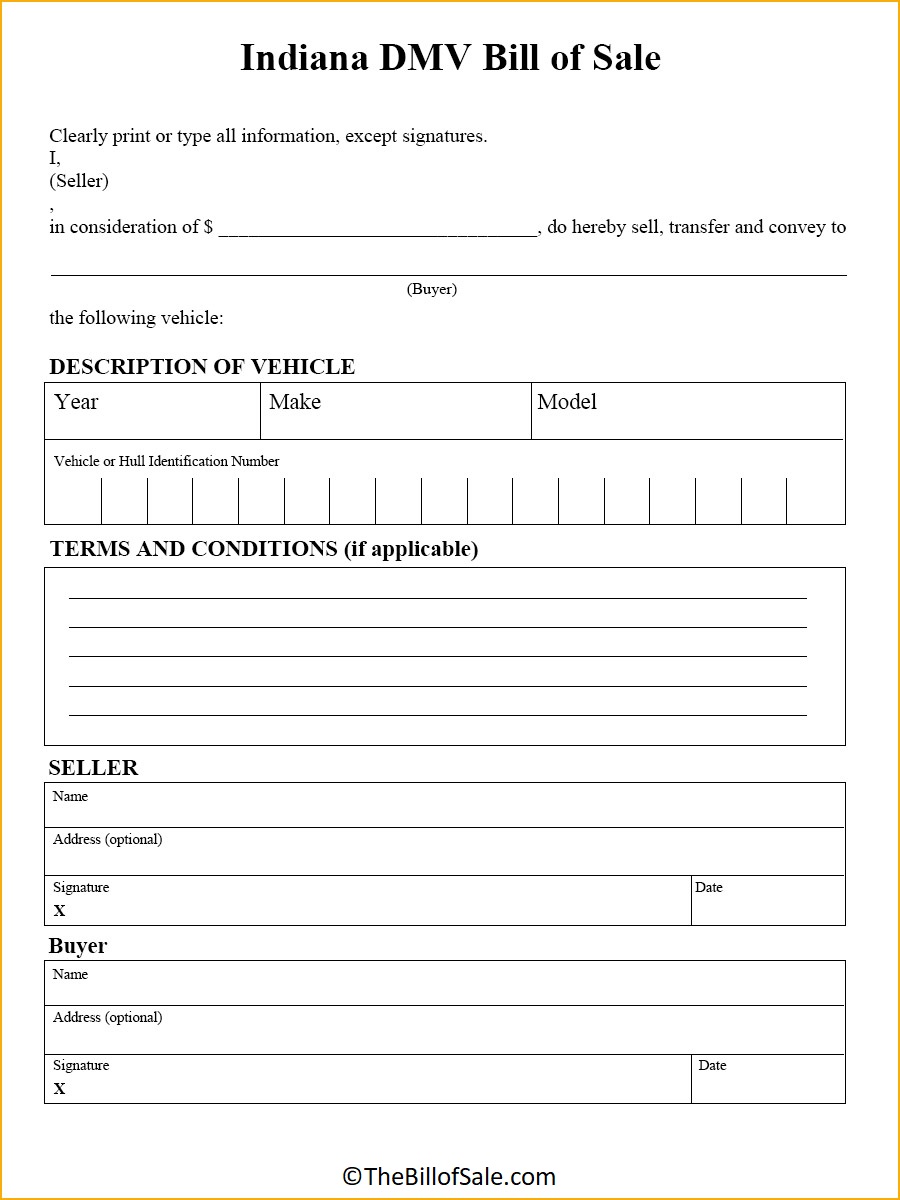

Indiana Bill of Sale For DMV

If you find it challenging to comprehend the structure of the Indiana bill of sale form. We encourage you to refer to the provided printable template. This template serves as an official resource to assist you in creating a formal bill of sale specifically tailored for the province of Indiana.

Following that, the seller can utilize it to document and finalize sales transactions within the state’s jurisdiction. It is crucial to complete the bill of sale form with all the necessary sale information to properly carry out the sales transactions. Additionally, certain sales transactions may necessitate the endorsement of a notary public for the finalization of the sale. Therefore, feel free to print the template for this bill of sale and utilize it appropriately for your sales transactions.

FAQs of Indiana Bill of Sale

Q1: What is an Indiana Bill of Sale?

An Indiana Bill of Sale’s a legal document used to record the sale and transfer of ownership of personal property within the state of Indiana. It serves as proof of the transaction and includes important details about the buyer, seller, item being sold, and the terms of the sale.

Q2: When do I need to use a Bill of Sale in Indiana?

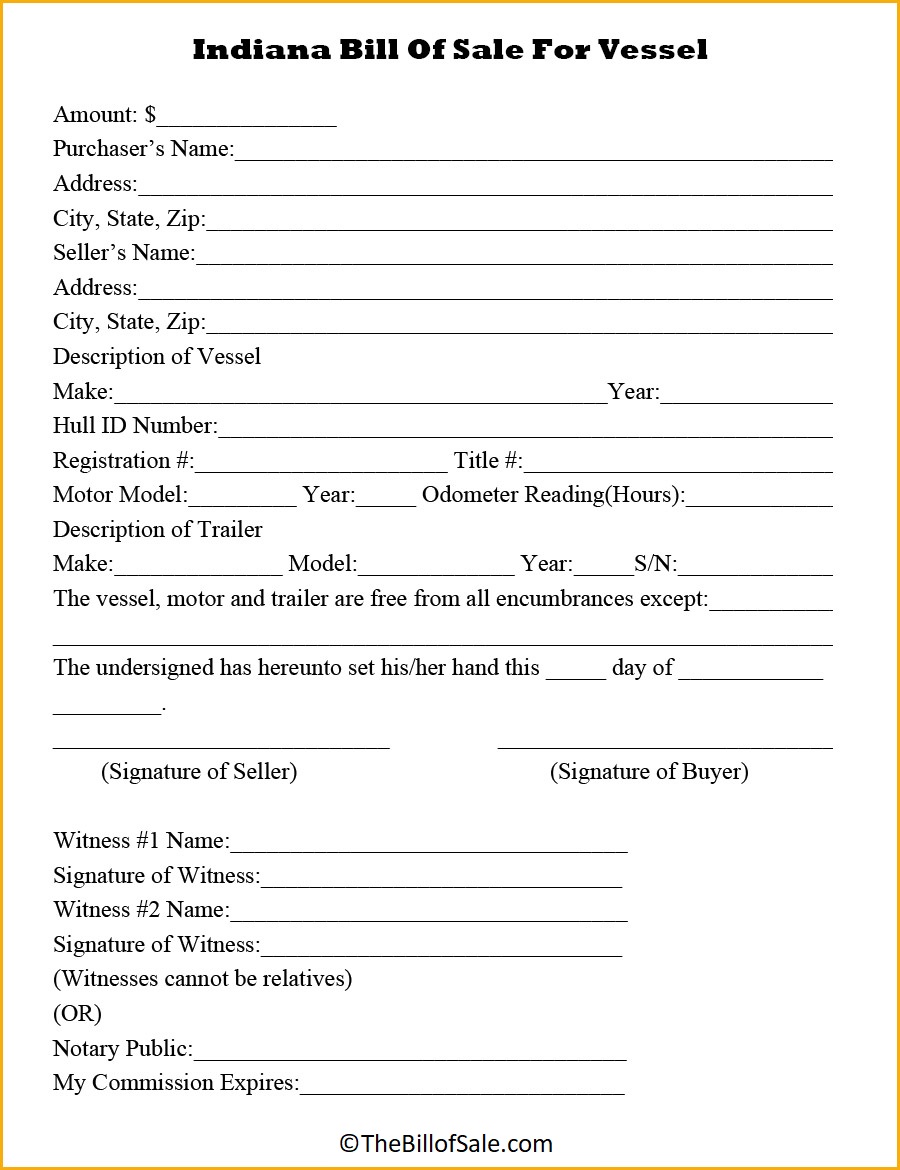

You may need to use a Bill of Sale in Indiana whenever you involved in the sale or purchase of personal property. Such as a vehicle, boat, firearm, furniture, or other valuable items. It’s advisable to use a Bill of Sale to protect both the buyer and seller’s interests and ensure a clear record of the transaction.

Q3: Is a Bill of Sale required in Indiana?

While Indiana law does not always require a Bill of Sale for every transaction. It’s highly recommend to use one to establish a legal record of the sale. A Bill of Sale helps protect both parties by documenting the terms and conditions of the transaction. Including the item’s description, purchase price, and the buyer and seller’s identities.

Q4: What information should included in an Indiana Bill of Sale?

An Indiana Bill of Sale should include essential details, such as the full names and addresses of the buyer and seller. The date of the sale, a description of the item being sold (including make, model, year, or serial number if applicable). The purchase price or trade-in value, and any warranties or conditions of the sale. Signatures of both parties are also necessary for the document’s validity.

Q5: Do I need to notarize the Indiana Bill of Sale?

In most cases, an Indiana Bill of Sale does not require notarization to be legally binding. However, notarizing the document adds an extra layer of authenticity and can be beneficial if any disputes arise in the future. Notarization also helps establish the identity of the parties involved and prevents fraud or misrepresentation.

Q6: Can I create my own Bill of Sale in Indiana?

Yes, you can create your own Bill of Sale in Indiana. While there are ready-made templates available that can assist you in drafting a comprehensive Bill of Sale. It is important to include all the necessary information to ensure its validity. Be sure to consult the relevant laws and regulations and consider seeking legal advice. If you have specific concerns or questions.

Q7: Where can I find a printable template for the Indiana Bill of Sale?

You can find printable templates for the Indiana Bill of Sale online. Many websites offer free or paid templates that you can download and customize to suit your specific needs. Ensure that the template you choose complies with Indiana’s legal requirements and contains all the necessary fields for a complete Bill of Sale.

Q8: Can I use a digital version of the Indiana Bill of Sale?

While a printed and physically signed Bill of Sale’s generally preferred. Using a digital version may be acceptable in some cases. However, it is advisable to consult with the buyer, seller, or legal professionals to determine the acceptability of a digital document for your specific transaction. It’s important to ensure the digital version maintains the integrity and authenticity of the agreement.

Q9: Is a Bill of Sale necessary for vehicle transfers in Indiana?

Yes, a Bill of Sale required for vehicle transfers in Indiana. When buying or selling a vehicle, both the buyer and seller must complete and sign a Bill of Sale. In addition to other required documentation, such as the vehicle title and registration forms. The Bill of Sale helps establish proof of ownership transfer and is important for tax, insurance, and legal purposes.

Q10: Do I need to keep a copy of the Bill of Sale?

Yes, it’s highly recommend to keep a copy of the Bill of Sale for your records. Retaining a copy ensures you have proof of the transaction and can refer to it in case of any disputes or future issues. It is also useful for tax purposes, insurance claims, and when transferring or registering the item in the future.